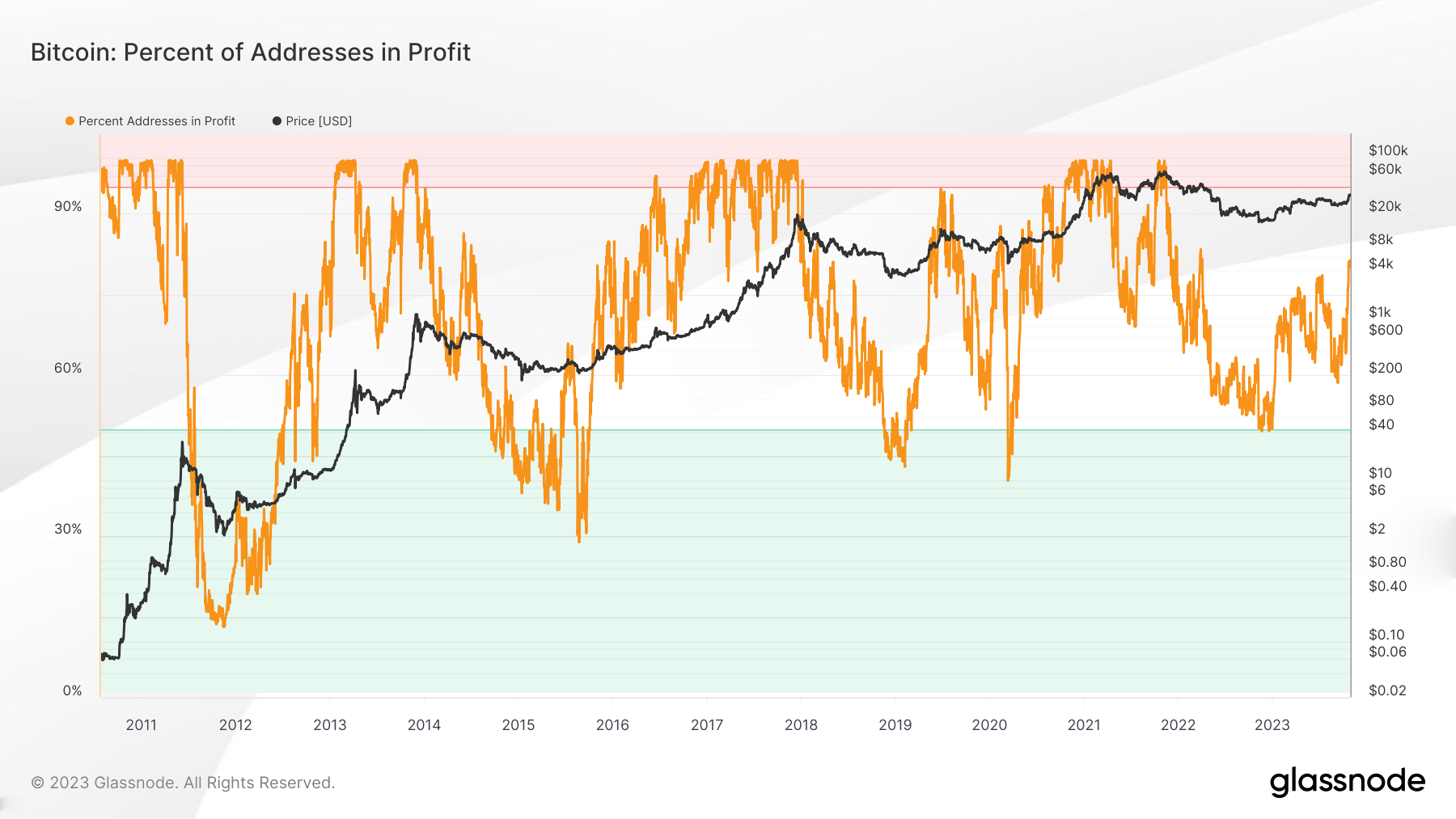

The waters of the crypto markets have been turbulent lately, but a record number of Bitcoin “surfers” continue catching profitable waves. According to the data analysts at Glassnode, over 80% of all Bitcoin addresses are now “in the black”—the highest percentage ever observed.

A Bitcoin Address Bonanza

Glassnode’s numbers reveal that nearly 40 million BTC addresses currently hold funds with a value greater than what was paid. This shatters the previous high of 38 million set last November when Bitcoin crashed through its old all-time price record.

While Bitcoin trades around 50% below its November ATH, the rising tide has managed to lift nearly every existing BTC address into profitability. Just two months ago, only about 60% of addresses held funds worth more than was paid in. Now, over eight out of every ten Bitcoin holders have caught a wave that’s carrying them to shore with profits piled in their surfboard bag.

Riding the ETF Anticipation Swell

Market observers think the continuing rotation into profit reflects growing optimism that the long-awaited Bitcoin ETF may finally break through regulatory shorebreak. Numerous filings from heavyweights like Fidelity, VanEck and more have the SEC considering whether to greenlight the first U.S. ETF with direct crypto exposure.

Analysts have tossed out some seriously swell-sized estimates on how much cash could come crashing into Bitcoin if ETF approval creates a massive influx of institutional demand. One figure floated by Roundhill Investments suggests a potential $3 billion injection just on day one of ETF availability.

Over the longer five-year period, projections get even gnarlier. Bitwise Asset Management’s CEO Matt Hougan estimates total ETF inflows could reach an eye-popping $55 billion – enough to generate monstrous market waves. As Hougan aptly pointed out, “the ones with the best marketing will succeed, but half will be gone within two years.”