Chainlink’s LINK token has seen a remarkable resurgence over the past week, pumping 26% and approaching prices not seen since early 2022. After a prolonged bear market, what is fueling this altcoin’s sudden revival?

The Perfect Storm for LINK

A confluence of factors has aligned to create the perfect environment for LINK’s price surge. Firstly, expectations are mounting around a spot Bitcoin ETF approval from the SEC. This would likely have a halo effect on altcoins like LINK.

Secondly, real-world asset (RWA) tokenization is poised to go mainstream, with major traditional finance players like HSBC launching digital asset services. As the dominant oracle network, Chainlink is well positioned to benefit from growing enterprise adoption of RWA tokenization.

Signs of Renewed Institutional Interest

The Grayscale Chainlink Trust (GLNK), which allows institutional investors to gain exposure to LINK, is currently trading at a massive 320% premium. This suggests surging demand from professional money managers.

Additionally, Chainlink was just listed on Hong Kong’s HashKey exchange, which caters to institutional traders. This adds to the narrative of revitalized institutional interest in LINK.

Bullish On-Chain Signals

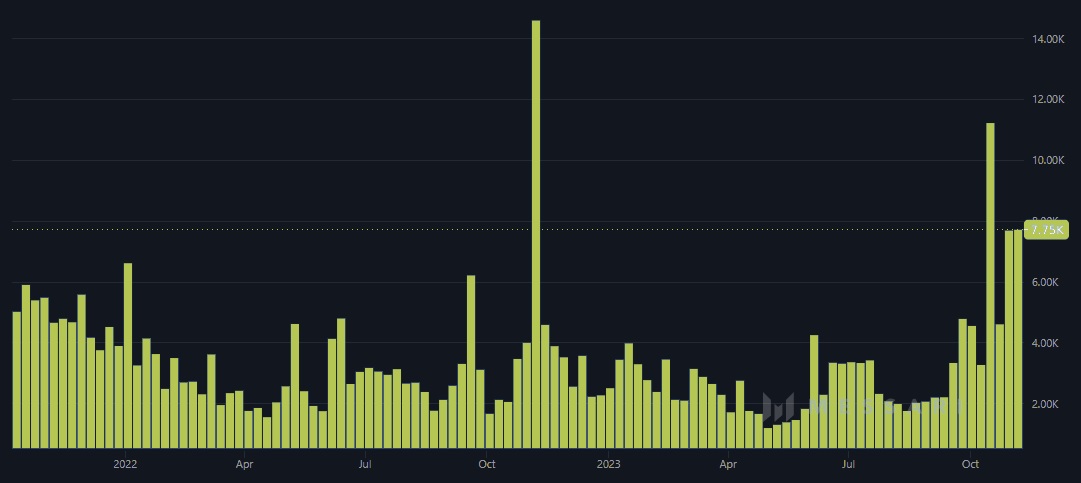

On-chain data paints a similarly optimistic picture. LINK’s network activity has picked up significantly, with the 1-day transaction count hitting multi-month highs.

LINK also ranks in the top 10 cryptocurrencies held by Ethereum whales, indicating strong accumulation by market leaders.

Upvember for LINK?

With momentum firmly on its side, traders are eyeing further upside for LINK above the psychological $14 level. Some analysts even believe LINK could rally as high as $15 in the near-term.

After months of rangebound trading, LINK is finally breaking out. With fundamentals and technicals aligning, Chainlink seems poised to make up for lost time and continue its uptober rally.

Rather than chasing pumps, smart traders should monitor on-chain and fundamental signals to identify sustainable breakouts. For LINK, the signs are clearly bullish for the oracle token to continue outpacing the broader market.