The cryptocurrency market has certainly been an exciting – and at times stomach-churning – ride over the past week. After months of gains that saw prices climb to fresh highs, many top coins like Bitcoin and Ethereum suddenly took a nosedive earlier this week. Let’s take a look under the hood to understand what triggered this bout of volatility and where the market seems to be headed next.

What Caused the Prices to Drop?

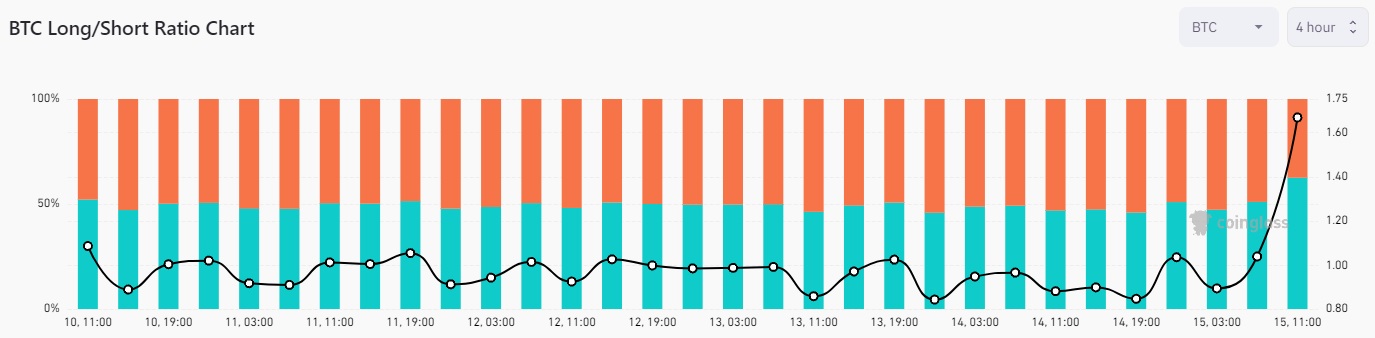

As those following the latest crypto news no doubt saw, prices tanked across the board on Tuesday with Bitcoin falling as much as 4% to briefly dip under $35,000. So what gave? According to analysis, a major flush out of leveraged long traders appeared to pull Bitcoin below key support levels. In other words, a cascade of liquidations totaling over $300 million worth kicked off when prices dipped, exacerbating the downturn. Another factor cited was declining enthusiasm over the imminent approval of a long-awaited Bitcoin ETF in the US.

TWEET: https://twitter.com/52kskew/status/1724701468949922120

Were Macro Factors at Play Too?

It’s also important to note the broader market context. Crypto markets tend to slump when risk assets like stocks retreat. Yet ironically, traditional markets were surging that day on surprisingly cooler inflation data out of the US. So the crypto market rejection of otherwise bullish macro news caught some off guard. Further, after months of rallying alongside expectations of a Bitcoin ETF, ebbing momentum on US regulators approving one may have played a role as well according to CoinMarketCap analysis.

So Is This Correction Cause for Concern?

Not necessarily! While the pullback delivered a gut punch to overleveraged traders,glass-half-full analysts point out that on-chain data shows a record high percentage of wallets remain in profit. Once liquidations cleared out excess leverage, downside appears capped for now. Short-term volatility is par for the course in crypto. The takeaway is not to panic sell at the first red candles. By analyzing market fundamentals and avoiding risky bets, long term holders can wait out periodic turbulence – and may be rewarded for doing so.

What Lies Ahead for Crypto Prices?

No one can say for certain, but insights from top industry voices imply the latest dip was merely a speed bump rather than the end of the road higher. Supportive factors like ongoing institutional adoption and emerging market growth suggest an inherent bullish bias remain intact. And as fresh liquidity enters the ecosystem, violent price swings may smooth out over time.

Of course, continued uncertainty around regulations and economic conditions leave crypto susceptible to headline risk as ever. But by staying level-headed and utilizing risk management best practices, savvy traders can take advantage of volatility rather than becoming its victim. The ongoing maturation of the crypto sector points to brighter days ahead – so remain tuned to Execrypto for developments on this story and other top blockchain and cryptocurrency news.