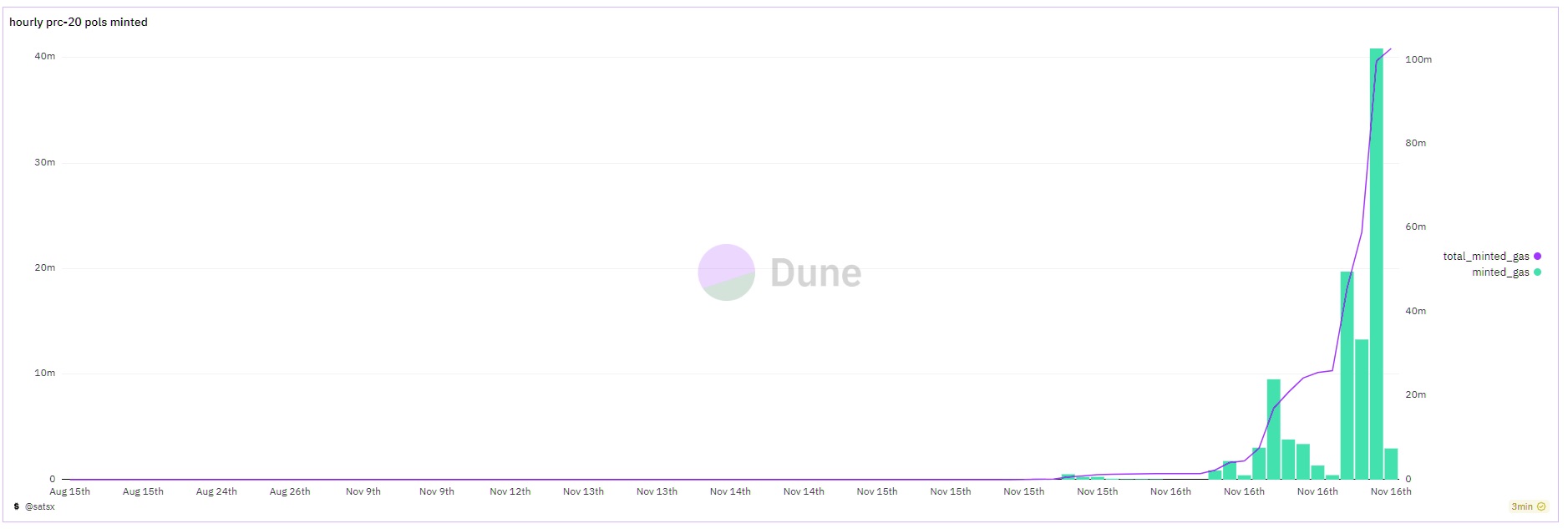

Have you heard about the latest crypto news? Blockchain networks saw a surge of activity in mid-November as excitement grew around a new type of token inspired by the Bitcoin Ordinals protocol. Namely, the Polygon network felt the effects as users rushed to mint “PRC-20” tokens called POLS. According to reports, this led transaction fees on Polygon to spike a whopping 1,000%! But to understand what happened, we need to take a step back and look at the protocols involved.

A Primer on Ordinals and BRC-20 Tokens

Ordinals is an experimental protocol that enables the direct creation of tokens and non-fungible tokens (NFTs) on the Bitcoin blockchain. It works by “inscribing” data into individual satoshis (the smallest unit of bitcoin) through transaction metadata. Inspired by this idea, some developers created a new token standard for Bitcoin called BRC-20.

BRC-20 tokens are basically like the popular ERC-20 tokens on Ethereum, but designed to work within the limitations of the Bitcoin protocol. As you can imagine, being able to freely create assets on Bitcoin itself was a huge novelty. And it drove a frenzy of activity as people rushed to claim these new BRC-20 tokens.

The Polygon Event

It seems a similar phenomenon occurred on Polygon in mid-November, when a token called POLS launched using a comparable “PRC-20” standard. As news of POLS spread on social media and crypto forums, hordes of users piled into the Polygon network hoping to stake their claim on the fresh new tokens. The spike in transactions was unprecedented – doubling the daily volume on Polygon virtually overnight according to blockchain data. With demand far exceeding the network’s capacity, fees shot up to 10 cents per transaction.

That’s a 1000% increase from the day before! It just goes to show how enthusiastically this community embraces new technologies – even if it means paying sky-high prices temporarily.

As a side note, Polygon is a scaling solution for Ethereum that aims to help the network bypass its current limitations of high fees and slow speeds. It does this through a “sidechain” system where transactions can be processed much more efficiently and then posted back to Ethereum. So in reality, skyrocketing Polygon fees were still a bargain compared to paying gas on the main Ethereum chain!

The Aftermath

Eventually as the initial frenzy died down, transaction volume and fees on Polygon returned to normal levels within a couple days. It seems the rush to be early adopters of POLS had run its course. However, this episode demonstrates blockchain technology’s ability to spawn viral phenomena. The cross-pollination of ideas between networks like Bitcoin and Ethereum and their protocols will likely continue to breed novel innovations. Events like these often bring valuable lessons about blockchain usability and capacity under load. As blockchain adoption increases, maintaining fast, affordable transactions will grow more important to ensure accessibility for all. Stay tuned for future crypto news by following EXEcrypto!

Every new development in the cryptocurrency world provides both progress and surprises. When viral crazes collide across protocols, they have the potential to briefly overwhelm even robust networks like Polygon.