Delaware finds itself at the center of some bizarre crypto news this week. As those keeping up with the latest cryptocurrency and blockchain news may have heard, authorities in Delaware are investigating a suspicious registration that someone filed falsely claiming Bitcoin & crypto giant BlackRock was launching a new exchange-traded fund (ETF) for the crypto XRP.

What was this mysterious XRP fund filing all about?

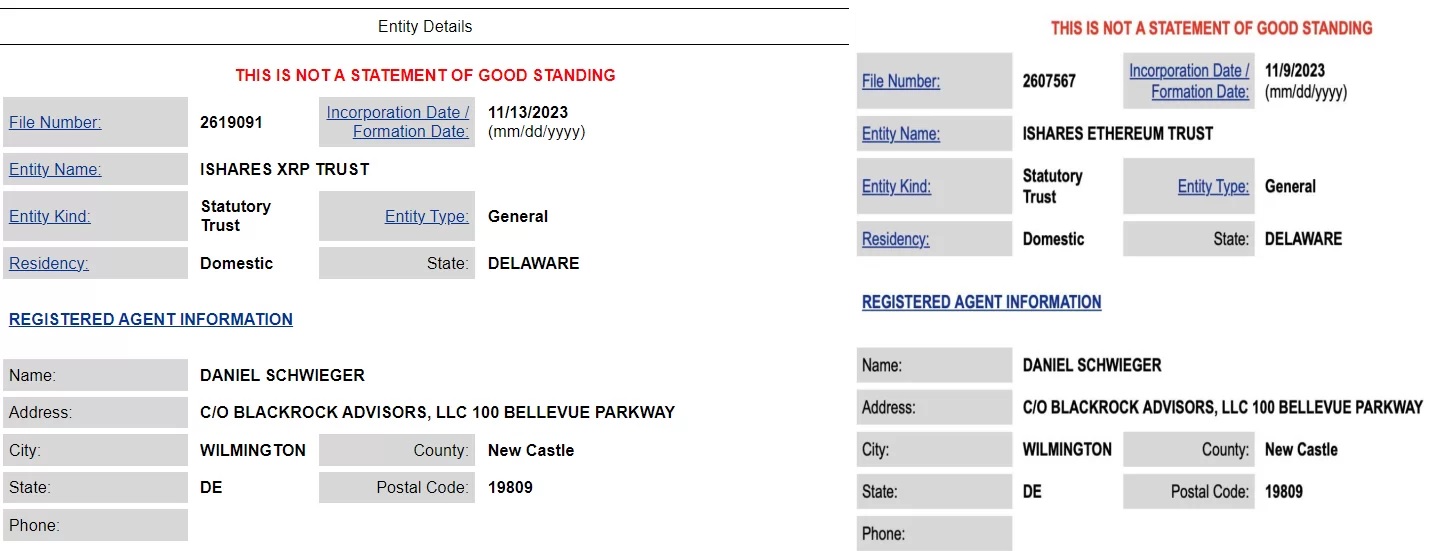

On November 13th, a registration mysteriously appeared on the website for Delaware’s Division of Corporations stating that asset management titan BlackRock had formed an “iShares XRP Trust” to issue shares linked to the price of XRP, the cryptocurrency associated with Ripple Labs. For those unaware, XRP is a cryptocurrency that aims to facilitate cross-border transactions by banks and payment providers.

This news sent price of XRP skyrocketing over 10% initially as investors excitedly speculated that BlackRock, one of the world’s biggest financial institutions, was endorsing XRP with plans for a new investment vehicle. However, the excitement was short lived. BlackRock was quick to confirm that it had not in fact registered any XRP trust or ETF. It became clear that someone had filed false public documents pretending to be BlackRock.

The plot thickens in Delaware

Delaware corporate law experts knew this strange filing raised some questions. How was someone able to impersonate a major company so easily and submit bogus public records to Delaware’s Division of Corporations website?

Authorities in Delaware began looking into this suspicious registration further. A spokesperson for Delaware’s Department of Justice told Bloomberg and other publications that the state has officially referred this fake BlackRock XRP filing to the Delaware Department of Justice for investigation.

It will be interesting to see in upcoming crypto news if authorities are able to uncover who was behind this scheme intended to artificially pump the price of XRP. Many believe this bizarre incident reveals flaws in Delaware’s process for vetting public entity registrations. While funny, these types of manipulative pumps can mislead investors and shake confidence in the credibility of crypto markets.

Regulators continue grappling with how to build confidence without stifling innovation as interest in cryptocurrency rises. Stories like this one will surely factor into those policy discussions going forward.

As this story develops further, be sure to check Execrypto for the latest crypto news updates. And stay vigilant – not everything you read about Bitcoin, Ethereum and other cryptocurrencies online can be taken at face value. Only invest what you can afford to lose, and do your research before acting on news that seems too good to be true.