The collapse of FTX continues to send ripples throughout the crypto industry. As the dust settles on the implosion of Sam Bankman-Fried’s empire, new developments emerge daily. The latest news involves significant crypto transfers from wallets linked to FTX and its sister trading firm Alameda Research.

A Closer Look at the Crypto Shuffles

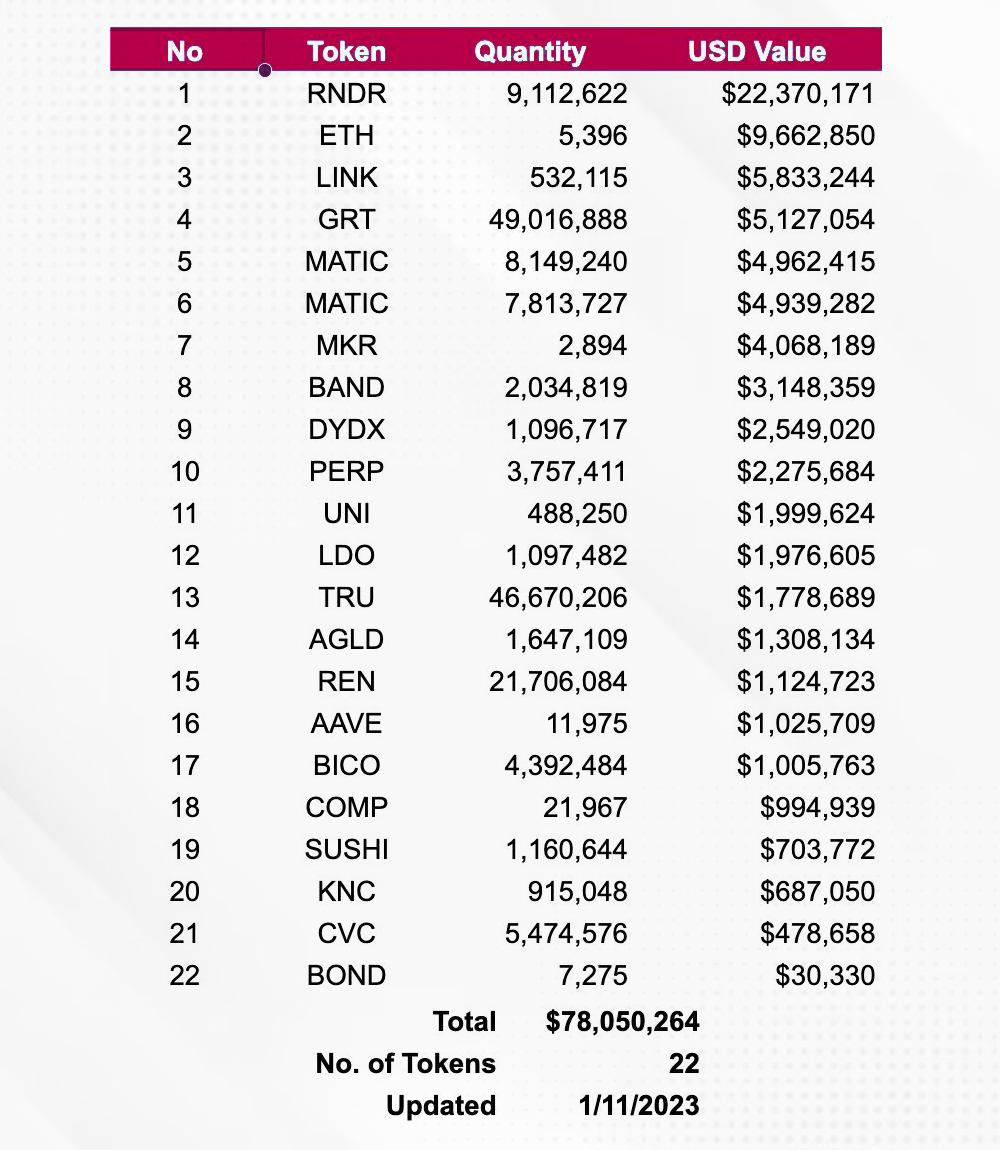

According to on-chain data, FTX and Alameda wallets have transferred over $13 million in crypto assets to major exchanges like Binance and Coinbase in the past week. The initial November 1st transfer saw $8.12 million in altcoins like GRT, RNDR, and MKR deposited to Coinbase. A few hours later, another $5.49 million shuffled to both Coinbase and Binance, including assets like DYDX, AXS, and AAVE.

TWEET: https://twitter.com/spotonchain/status/1719538407674962192

These transactions appear to be part of a broader pattern of activity. Analytical firms like Nansen have flagged millions of dollars worth of crypto flowing from FTX and Alameda wallets to exchanges over the past month.

In total, analytics site SpotOnChain estimates that $83.6 million in assets have moved this way, across 26 different cryptocurrencies. It’s a substantial shuffling of digital wealth.

Reading the Tea Leaves

But what’s motivating these big transfers? The short answer is, we can only speculate. However, some clues provide context.

In September, a court ruling allowed FTX to begin liquidating assets to manage risks. The approval came with limits, starting at $50 million per week, later raised to $100 million weekly.

It’s possible the transfers represent FTX selling assets or preparing to do so. Liquidations this large inevitably impact market prices. However, Coinbase stated they anticipate minimal disruption from working within FTX’s set limits.

The motivations are still uncertain. But it’s clear that FTX’s crypto fortune continues flowing out of the shadow of Sam Bankman-Fried and into new hands. The saga provides a sobering case study for investors on the risks of centralized entities in the crypto ecosystem.