Michael Saylor and his business intelligence firm MicroStrategy have established themselves as the biggest corporate holders of bitcoin in the world. And it seems they have no plans of slowing down their bitcoin acquisition strategy any time soon.

MicroStrategy’s Bitcoin Stash Grows to Über Proportions

In its latest earnings report, MicroStrategy revealed that it had increased its bitcoin holdings by over 6,000 coins in the third quarter alone. That brought its total bitcoin holdings to a whopping 158,400 BTC as of October 2023.

To put that into perspective, MicroStrategy now controls more bitcoin than many small countries. If bitcoin was a national treasury, MicroStrategy would rank somewhere in the top 20 globally by bitcoin reserves.

TWEET: https://twitter.com/saylor/status/1719807461719216241

But Saylor and company weren’t done adding to their colossal bitcoin position. In a tweet celebrating Halloween, Saylor casually mentioned that MicroStrategy had bought another 155 BTC in October for $5.3 million. At this rate, they may soon have more bitcoin than some mid-sized nations!

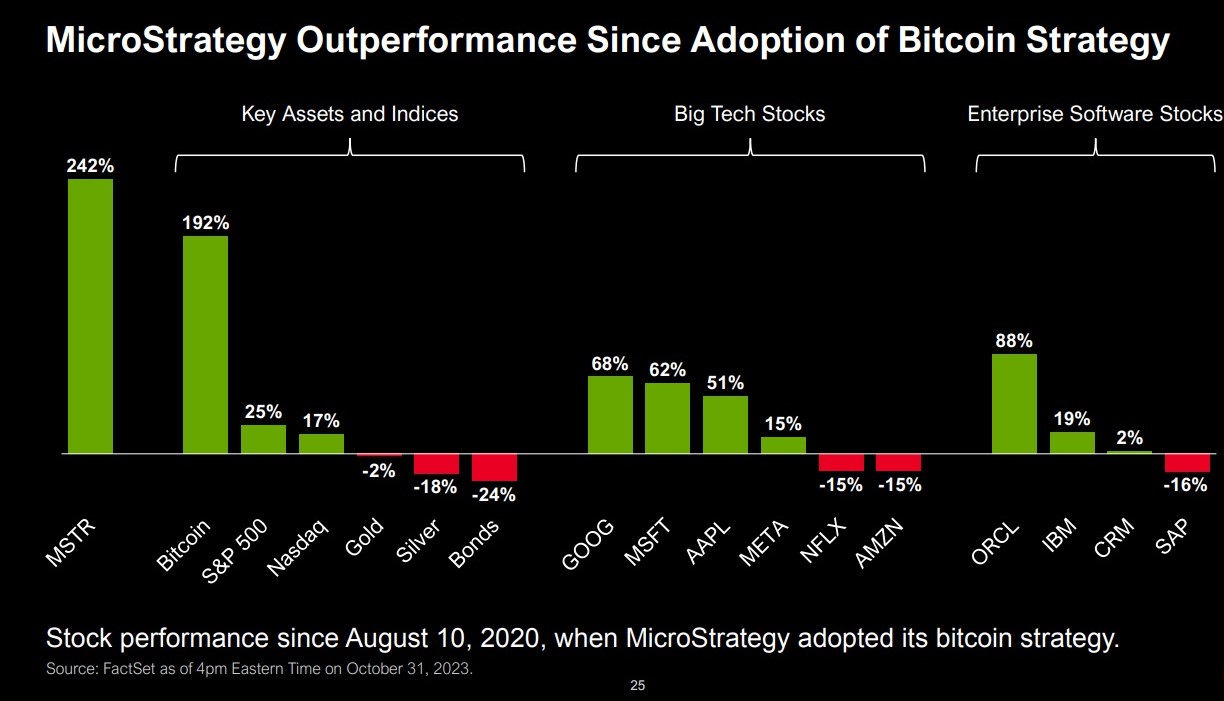

The Mother of All Bitcoin Bets Continues Paying Off

And MicroStrategy’s bitcoin bet is certainly paying dividends. The firm calculated it has an unrealized gain of a whopping $900 million on its bitcoin holdings thanks to BTC’s price appreciation in recent months. Not a bad return for a few years’ worth of corporate bitcoin DCA!

Better yet, MicroStrategy’s revenue was up 3% year-over-year despite the choppy economic conditions. So their core business remains steady as their bitcoin investment kicks them silly gains.

It’s clear Saylor isn’t letting any grass grow under his feet in adding more sats to the treasury. While others ponder bitcoin exposure, Saylor has gone all in and dug his heels in deeper than a prairie dog in a dust storm. And so far, it’s proven to be one of the savviest corporate moves in recent memory.