The Solana blockchain has undoubtedly faced its fair share of challenges in recent months. However, amidst the FUD, key factors suggest SOL’s long term potential remains very much intact. Let’s take a deeper dive into Solana’s price movements, evolving traction, and why its future may be brighter than some assume.

SOL Corrects as Rally Factors Come Into Question

SOL saw a notable 10% price correction in early November after failing to break past key resistance at $44.50. This brought about inevitable questioning from investors as to whether Solana’s ecosystem growth justified its $16.9 billion market cap.

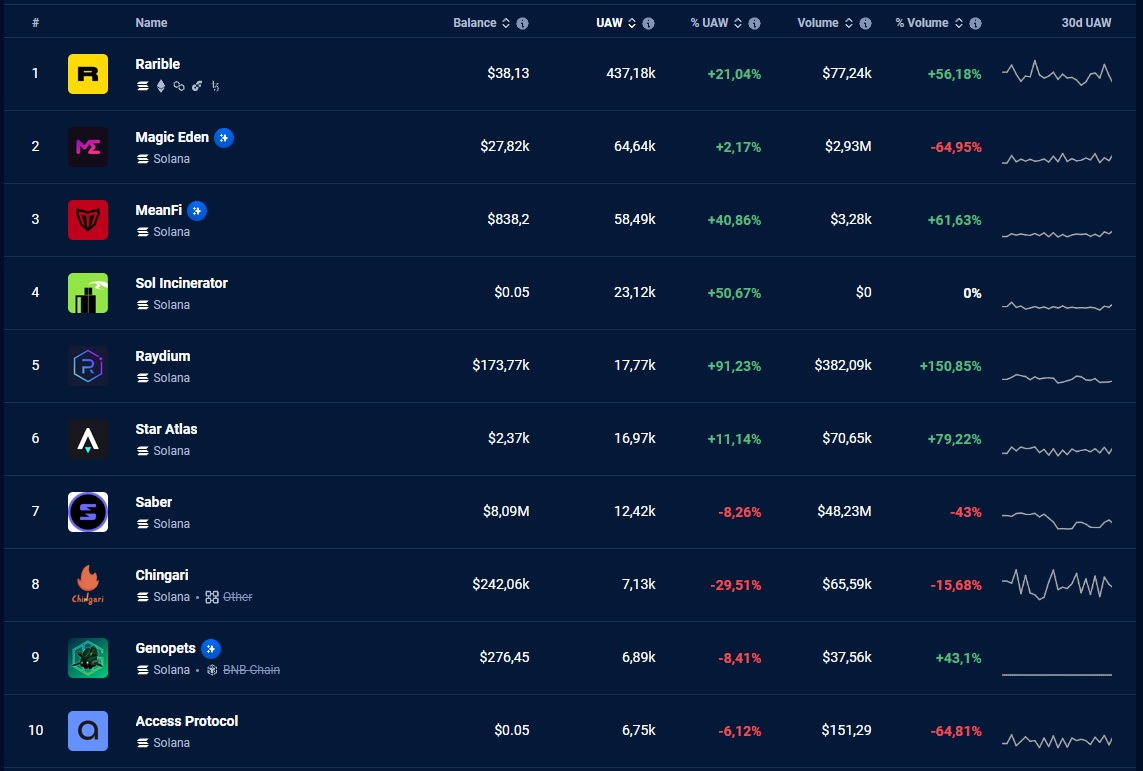

While development continues at a brisk pace, some metrics told a less rosy story. Total value locked on the network declined 30% from its September peak, with daily active addresses on major dApps like Raydium also trending downward. Transaction volumes lagged behind competitors like BNB Chain as well.

Were these red flags or predictable volatility for a blockchain still in its adolescence? As with any investment, measuring trajectory over time is wise before making sweeping judgments. Solana’s direction remains an open question, but long term potential remains if network effects continue compounding.

FTX Fallout Clouds the Picture

Over $102 million in SOL tokens were transferred from bankrupt FTX’s wallets to exchanges like Binance and Kraken – a clear sign liquidation was underway. This massive overhang understandably placed short term selling pressure on the price.

However, the implications of FTX’s shady dealings extend far beyond any single project. As a leading exchange, its failure to self-regulate damaged consumer trust across the crypto sector. For Solana, the real impact may be felt more through this lingering perception challenge than any direct fallout.

With new leadership and an expanding developer community committed to building on its technology, Solana is well positioned to rehabilitate its image over the long run. Progress, not past problems, will dictate its success. As with any recovery, expect continued volatility – but also opportunity for those with faith in its future.